Articles Posted in PRACTICE OF LAW

Brockton, Massachusetts Police Officer Cannot Recover from Hospital for Personal Injuries

Boston Massachusetts Personal Injury Attorney, the attorney , reviews a recent Supreme Judicial Court case involving an injured police officer:

A Massachusetts police officer who suffered serious personal injuries, while responding to a motor vehicle/pedestrian accident, cannot recover from the hospital, which treated and released the pedestrian just prior to the accident, says the Massachusetts Supreme Judicial Court.

In November, 2004, the Brockton, Massachusetts police officer, was responding to a car accident involving a pedestrian, While driving to the accident scene, the officer’s police cruiser was struck by another vehicle resulting in serious and permanent injuries to the officer. He was responding to an accident in which an individual just released from Brockton Hospital had been struck and killed by a motor vehicle.

In November, 2004, the Brockton, Massachusetts police officer, was responding to a car accident involving a pedestrian, While driving to the accident scene, the officer’s police cruiser was struck by another vehicle resulting in serious and permanent injuries to the officer. He was responding to an accident in which an individual just released from Brockton Hospital had been struck and killed by a motor vehicle.

The patient had undergone a colonoscopy at the hospital earlier in the day and had been given Demerol and Versed, both narcotic sedatives. The hospital had a written policy, which prevented patients who had been given narcotics from being discharged without an escort. This patient left the hospital with no escort.

The Plaintiff police officer had alleged that the hospital was negligent and had a duty of care to protect third parties from harm caused by its “impaired” patients. The officer claimed that the hospital had a special medical relationship with its patient prior to him leaving the premises, which created a duty to control the patient’s conduct in order to protect against harm the patient might cause to others, even after the patient had been discharged.

Millennium Bank Ponzi Scheme: “Show me the Money, Willie”

A closer look at the Millennium Bank Ponzi Scheme: Boston trial lawyer, the attorney, takes a look at the facts involving Caribbean based Millenium Bank, which operated out of offices in Napa, California until closed by the SEC in March, 2009.

William J. Wise had a problem. In late 2003, his fledgling bank in tiny St. Vincent and Grenadines (SVG) was not generating sufficient income from investor deposits to support either the bank’s overhead or his own extravagant personal lifestyle. The island’s banking regulators had moved to suspend Millennium’s license to operate, and Wise was scrambling.

William J. Wise had a problem. In late 2003, his fledgling bank in tiny St. Vincent and Grenadines (SVG) was not generating sufficient income from investor deposits to support either the bank’s overhead or his own extravagant personal lifestyle. The island’s banking regulators had moved to suspend Millennium’s license to operate, and Wise was scrambling.

After filing an appeal of the bank’s suspension order, Wise appears to have struck a deal with the SVG banking authority, which gave the bank new life. The bank would re-capitalize and an outside controller would be put in place to oversee the Millennium’s operations. Many believe that the SVG banking authority made the deal only after Mr. Wise had made donations, some of it cash, to select members of the ruling party on the island.

At this point Wise needed a new strategy. And indeed it appears he came up with a new “business plan”. SVG would remain the titular base of the bank’s operations, but banking activity, and in particular the movement of money would go elsewhere, avoiding the watchful eye of the controller and the SVG authorities. Wise would move operations to Napa, California, and create fictitious Limited Liability Companies (LLC’s) in Las Vegas, Nevada, based loosely on Millennium’s purported Swiss parent, United Trust of Switzerland, in order to open bank accounts there.

At this point Wise needed a new strategy. And indeed it appears he came up with a new “business plan”. SVG would remain the titular base of the bank’s operations, but banking activity, and in particular the movement of money would go elsewhere, avoiding the watchful eye of the controller and the SVG authorities. Wise would move operations to Napa, California, and create fictitious Limited Liability Companies (LLC’s) in Las Vegas, Nevada, based loosely on Millennium’s purported Swiss parent, United Trust of Switzerland, in order to open bank accounts there.

To promote new business, he would combine an aggressive internet and print advertising campaign with an irresistible banking product, “safe” high interest Certificates of Deposit (“CDs”), which no American bank could match or even approach.

The Millennium line of CD products could easily be found on a newly created interactive website, whose sponsored links began to regularly and prominently appear on popular search engines such as Google and Yahoo. Potential customers would type in keywords seeking “high interest CDs”, and Millennium’s three line ad would appear with a link to the bank website.

Toll free numbers were provided on the Website, which directed calls to the Napa offices, and apparently the calls started coming in. Reluctant callers were referred to several U.S. based Milllennium Bank representatives, whose job was to reassure these potential investors and close new business, earning commissions on the gross amount of the monies deposited. These “finders” were authorized and instructed to develop personal relationships with clients, often traveling to have face to face meetings. Customers were assured that their money was safe, as the representatives advertised that they too were investors.

Conflict of Interest Evident when Disability Insurer Both Reviews and Pays Claim for Benefits Says First Circuit Court of Appeals

Massachusettts Personal Injury Attorney, the attorney, reviews and analyzes a recent U.S. First Circuit Court of Appeals decision. This is the second part of a two part blogpost, involving the denial of an employee long term disability claim, where the insurer both reviewed and paid claims, allegedly giving rise to a conflict of interest. The First Part reviewed facts leading up the to the employee’s application for long term disability insurance, which the insurer rejected, and resulted in an action in Federal District Court.

In June of 2002, the plaintiff employee in this case filed for long-term benefits. She would qualify as disabled under the long-term plan if, for two consecutive years, she was unable to perform the material and substantial duties of her occupation, and subsequently was unable to perform “the material and substantial duties of any occupation”. The same Liberty nurse who had denied her earlier claim, also reviewed this file, which contained medical support for a finding that the plaintiff’s symptoms had become worse. She had also completed an activities questionnaire in which she claimed to have severe restrictions on her ability to sit, stand, walk, drive, and concentrate.

In her second review, the Liberty Mutual nurse discounted the IME report, suggested that the plaintiff’s condition was not as grave as the completed questionnaire implied, concluded that the plaintiff did not qualify for benefits and Liberty denied the claim. The plaintiff requested further review. Liberty responded by hiring a private investigator to observe the plaintiff’s activities. The investigator produced reports and photographs showing that the plaintiff was active.

In her second review, the Liberty Mutual nurse discounted the IME report, suggested that the plaintiff’s condition was not as grave as the completed questionnaire implied, concluded that the plaintiff did not qualify for benefits and Liberty denied the claim. The plaintiff requested further review. Liberty responded by hiring a private investigator to observe the plaintiff’s activities. The investigator produced reports and photographs showing that the plaintiff was active.

With this information, Liberty then utilized a referral service furnishing physicians to evaluate the functional abilities of claimants. One of its physicians concluded that the plaintiff was capable of working full-time in her primarily sedentary position. On December 10, 2002, Liberty reaffirmed its earlier denial of benefits.

Fourteen months later, an administrative law judge ruled the plaintiff was entitled to social security disability benefits retroactive to her last day of actual work. The judge premised this decision on a subsidiary finding that the plaintiff was disabled within the meaning of the Social Security Act. Although the definition of disability under the Act differed from the definition of disability under the Liberty’s plan, the plaintiff forwarded the SSDI ruling to Liberty, along with a further report from her rheumatologist, seeking reconsideration of the denial.

Liberty refused to reverse its decision, which resulted in the district court action. The U.S. District Court granted summary judgement to Liberty, deciding that Liberty had not abused its discretion in denying the claim. On initial appeal, the Appeals Court affirmed, but then the United States Supreme Court made a ruling, which changed the substantive law in the area and resulted in a successful request for rehearing of this case.

I n rehearing the case, the Court analyzed the Supreme Court’s decision in Metropolitan Life Insurance Co. v. Glenn , 128 S. Ct. 2343 (2008) . There, the Supreme Court had reviewed a denial of benefits by an administrator that passed judgment upon and paid claims under an ERISA-regulated plan. It concluded that courts should recognize that a conflict exists whenever a plan administrator, whether an employer or an insurer, is in the position of both adjudicating claims and paying awarded benefits.

n rehearing the case, the Court analyzed the Supreme Court’s decision in Metropolitan Life Insurance Co. v. Glenn , 128 S. Ct. 2343 (2008) . There, the Supreme Court had reviewed a denial of benefits by an administrator that passed judgment upon and paid claims under an ERISA-regulated plan. It concluded that courts should recognize that a conflict exists whenever a plan administrator, whether an employer or an insurer, is in the position of both adjudicating claims and paying awarded benefits.

Boston Personal Injury Attorney Reviews Federal Decision Acknowledging Conflict of Interest when Disability Insurer Reviews Request and Also Pays Employee Benefits

This is the first of a two part Blogpost, where Massachusettts Personal Injury Attorney, the attorney, reviews and analyzes a recent First Circuit U.S. Court of Appeals decision. The case involves an employee disability claim and issues pertaining to a perceived conflict of interest.

In this case, the U.S. First Circuit Court of Appeals remanded a case to the District Court, where an employee challenged the denial of her request for long-term disability benefits. The Plaintiff alleged that the employer’s insurer, who denied her benefits, both reviewed and decided on her eligibility and was responsible for the payments, which was a conflict of interest. She also alleged that a physician referral service the insurer utilized was biased, given it generated large revenues from its reviews, and usually recommended in favor of the employer.

In this case, the U.S. First Circuit Court of Appeals remanded a case to the District Court, where an employee challenged the denial of her request for long-term disability benefits. The Plaintiff alleged that the employer’s insurer, who denied her benefits, both reviewed and decided on her eligibility and was responsible for the payments, which was a conflict of interest. She also alleged that a physician referral service the insurer utilized was biased, given it generated large revenues from its reviews, and usually recommended in favor of the employer.

The Court justified the remand, based on a recent decision of the United States Supreme Court in Metropolitan Life Insurance Co. v. Glenn , 128 S. Ct. 2343 (2008). The Supreme Court had previously reviewed a denial of benefits by an administrator that passed judgment upon and paid claims under an ERISA-regulated plan. It concluded that courts should recognize that a conflict exists whenever a plan administrator, whether an employer or an insurer, is in the position of both adjudicating claims and paying awarded benefits.

In this case, in 1996 a primary care physician had diagnosed the plaintiff employee as suffering from fibromyalgia, which is a disorder involving muscle and connective tissue pain. Patients note heightened and painful response to gentle touch, as well as debilitating fatigue, sleep disturbance, and joint stiffness. The plaintiff was a group leader employed by GenRad, Inc. In spite of the diagnosis, she continued to work. At the time she was covered under a short-term and a long-term disability insurance plan supplied by Defendant, Liberty Life Assurance Company (Liberty), who also administered both plans.

In this case, in 1996 a primary care physician had diagnosed the plaintiff employee as suffering from fibromyalgia, which is a disorder involving muscle and connective tissue pain. Patients note heightened and painful response to gentle touch, as well as debilitating fatigue, sleep disturbance, and joint stiffness. The plaintiff was a group leader employed by GenRad, Inc. In spite of the diagnosis, she continued to work. At the time she was covered under a short-term and a long-term disability insurance plan supplied by Defendant, Liberty Life Assurance Company (Liberty), who also administered both plans.

Millennium Bank Scam: William Wise successfully reversed the St. Vincent and Grenadine Banking Authority’s attempt to revoke its License in 2004

Boston commercial and personal injury trial Lawyer, the attorney, takes a look at Caribbean based Millenium Bank, the latest banking Ponzi Scheme to have bilked U.S. and other investors seeking big returns on their investment monies.

On March 27, 2009, St. Vincent and the Grenadines (SVG), by its International Financial Service Authority (IFSA), appointed KPMG-International to assume control over the affairs of Millennium Bank (“Millennium”) in order “to preserve records and assets”. The IFSA was acting on information obtained from the U.S. Securities and Exchange Commission (SEC), after the SEC had issued a civil complaint against Millennium Bank, a number of affiliates and individual participants, including William J. Wise, Kristi Hoegel and Jackie Hoegel.

This, however, was not the first time that the IFSA had taken action gainst Millennium. In fact, in 2004, the IFSA had legally moved to revoke Millennium’s license, a decision the SVG government later reversed, allegedly after the prime minister of SVA intervened on its behalf. Court documents indicate that William Wise, representing himself as a duly licensed Canadian legal counsel appealed the suspension, and ultimately prevailed.

This is when things ostensibly turned for the better for the once fledgling offshore bank. Undertaking an aggressive international marketing campaign led by Wise, deposits grew dramatically based on the promise of high interest CDs, rates which no U.S. bank could even come close to matching. It appears that the plan was successful as deposits grew in dramatic fashion.

Unfortunately for investors, who believed they were buying legitimate certificate of deposits in exchange for their cash, it appears that the bulk of the funds were being diverted to accounts held by Wise, principally at Washington Mutual Bank in Las Vegas, Nevada, and used for the personal needs and extravagances of these individuals.

Millennium Bank Fraud: Perpetrators Aggressively Used Internet and Print Media to Advertise High Interest CDs: Should publishers have known something was amiss?

Boston commercial and personal injury trial Lawyer, the attorney, takes a look at Caribbean based Millenium Bank, the latest banking Ponzi Scheme to have bilked U.S. and other investors seeking big returns on their investment monies.

On March 25, 2009 the United States Securities Exchange Commission commenced a civil action in United States District Court in Northern Texas against the The Millennium Bank, and it principals, alleging violations of the securities laws of the U.S. According to most recent information from the SEC, it appears that there are now over 1000 investors who placed at in excess of $100 million dollars in the bank and its affiliates, hoping to secure high interest rate CDs, rates at two to three times that of the highest rates available in the U.S.

Information is now emerging that Millennium nurtured customers with an internet marketing plan targeted at individuals shopping for the best returns on term Certificates of Deposit. One was www.Bankrate.com, which is a website widely used by investors to determine the prevailing rates for investment and mortgage products in the U.S. Millennium regularly ran banner ads on this site. Victims also report that google “sponsored ads” regularly appeared when the Google seach engine was employed in searches for “high interest CDs”

Information is now emerging that Millennium nurtured customers with an internet marketing plan targeted at individuals shopping for the best returns on term Certificates of Deposit. One was www.Bankrate.com, which is a website widely used by investors to determine the prevailing rates for investment and mortgage products in the U.S. Millennium regularly ran banner ads on this site. Victims also report that google “sponsored ads” regularly appeared when the Google seach engine was employed in searches for “high interest CDs”

According to the SEC complaint, Millennium Bank also ran advertisements of its high-yield no-risk CDs in print magazines and their Internet counterparts, including The Wealth Collection, Wealth Management Agenda and Haute Living . For instance, Millennium ran a promotional article in the March 2008 edition of The Wealth Collection , a bi-annual magazine that touts the latest in “luxury lifestyle trends, investment opportunities and wealth management”.

According to the SEC complaint, Millennium Bank also ran advertisements of its high-yield no-risk CDs in print magazines and their Internet counterparts, including The Wealth Collection, Wealth Management Agenda and Haute Living . For instance, Millennium ran a promotional article in the March 2008 edition of The Wealth Collection , a bi-annual magazine that touts the latest in “luxury lifestyle trends, investment opportunities and wealth management”.

Employee’s Personal Injuries After Fall through Open Trap Door in Floral Shop does not Warrant Double Compensation, Says Appeals Court

Boston Personal Injury Lawyer, the attorney, analyzes a recent Appeals Court decision pertaining to double penalties under the Worken’s Compensation Act.

The case involves a store employee who suffered serious personal injuries after falling through a trap door in the floor of a floral shop, the Massachusetts Appeals Court has reversed a decision by the Department of Industrial Accidents reviewing board that awarded an employee double compensation (under Mass. G.L. c. 152, § 28), finding that the employee’s injury was due to the serious and wilful misconduct of the employer. The Appeals Court determined that the record did not support a finding that the employer’s conduct rose to the level of a wanton and reckless disregard for safety.

The employee was working at a floral shop on Valentines day in 1991 when she fell into a trap-door floor opening, which covered a set of stairs leading down to the cellar. She fell into the hole sustaining serious personal injuries. The floor door measured approximately eight feet by three feet, and qualified as a “floor opening”, which made it subject to the state and federal regulations, and certain mandatory safeguards.

The employee was working at a floral shop on Valentines day in 1991 when she fell into a trap-door floor opening, which covered a set of stairs leading down to the cellar. She fell into the hole sustaining serious personal injuries. The floor door measured approximately eight feet by three feet, and qualified as a “floor opening”, which made it subject to the state and federal regulations, and certain mandatory safeguards.

The employer was not aware of the regulations, and instead relied on its own warning system of orange safety cones and chains to warn and protect the employees. However, the system was only used sporadically, and was not in place on the day of the accident. There was also some evidence that there may have been insufficient floor space in the area of the trap door due to the placement of a table for completed work orders. There was also evidence that because it was Valentine’s day, the work pace in the store was much heavier than normal.

Millennium Bank Ponzi Scheme – Offshore High Interest CD’s seemed too Good to be True and Were, Says SEC

Boston commercial and personal injury trial Lawyer, the attorney, takes a look at Caribbean based Millenium Bank, the latest banking Ponzi Scheme to have bilked U.S. and other investors seeking big returns on their investment monies.

The Millenium Bank and United Bank of Switzerland have been marketing and offering highly attractive CD rates for several years now, advertising in glossy high end magazines as well as online, and it now appears that those interest rates that seemed too good to be true indeed were.

The Millenium Bank and United Bank of Switzerland have been marketing and offering highly attractive CD rates for several years now, advertising in glossy high end magazines as well as online, and it now appears that those interest rates that seemed too good to be true indeed were.

On March 25, 2009 the Securities Exchange Commission commenced a an emergency action in the United States District Court for the Northern District of Texas seeking to enjoin Millenium and its affiliates from carrying on any future business and taking steps to recover assets of the companies and the principals who ran them, who were located in California and North Carolina.

The

SEC Complaint alleges that Defendants William J. Wise, 58, of Raleigh, North Carolina and the Caribbean, and Kristi M. Hoegel, 34, of Napa, California, orchestrated the scheme through companies they control, including co-defendants Millennium Bank of St. Vincent and the Grenadines, its Geneva, Switzerland-based parent, United Trust of Switzerland S.A., and its U.S.-based affiliates, UT of S, LLC and Millennium Financial Group.

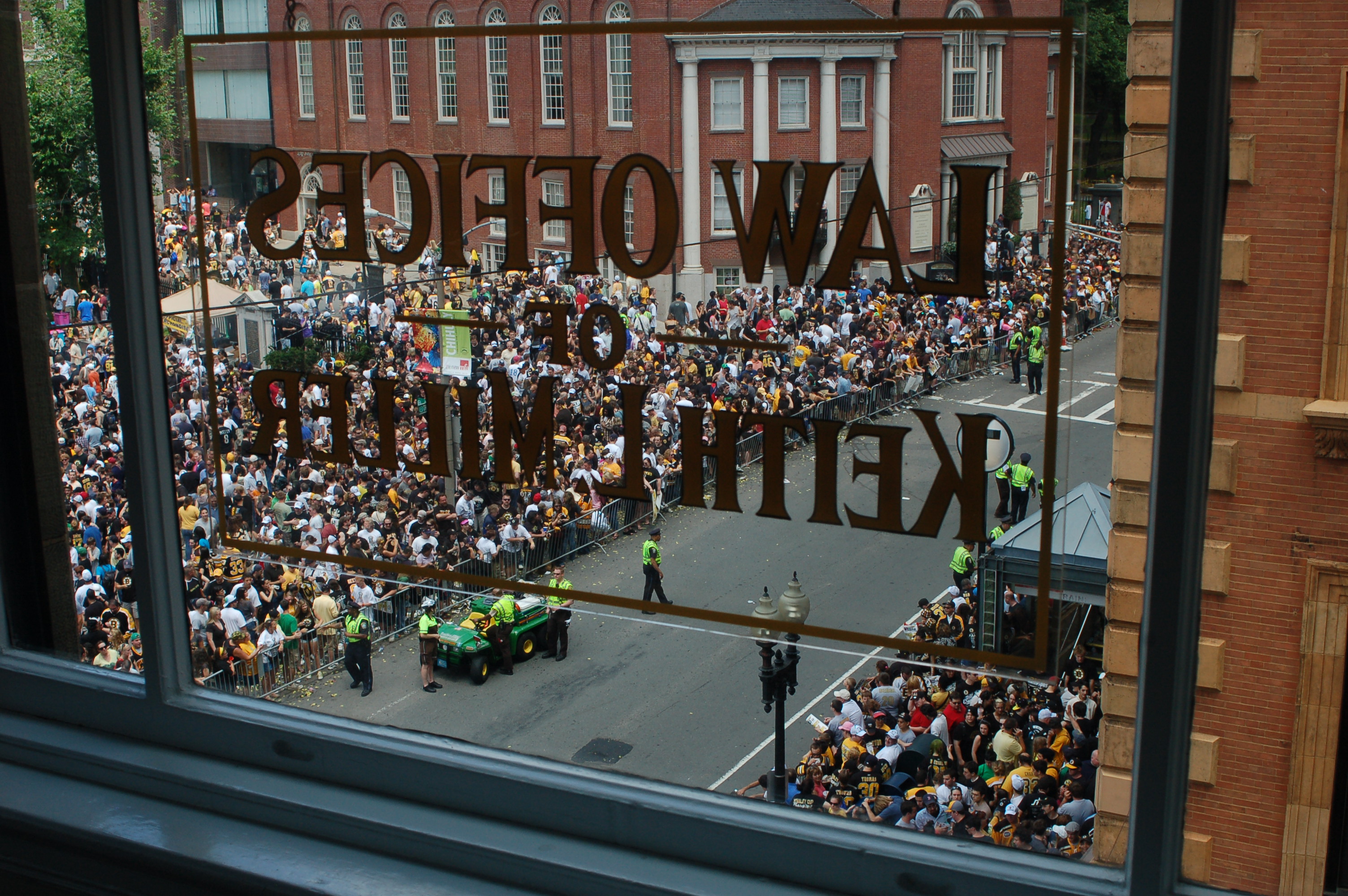

Boston Accident and Injury Lawyer

Boston Accident and Injury Lawyer